Does Germany has the best health insurance?

We explain the ins and out of arranging public and private health insurance in Germany and what both options can offer expats working in the country.

German expats who live in Germany have the right to state healthcare. This is paid for by social security contributions. Higher earners will need to sign up for private insurance. This can provide shorter wait times and better hospital conditions.

This guide provides information about all aspects of German health insurance, including:

- Germany’s healthcare system and insurance for health

- German public health insurance

- How to apply for public health insurance

- Private insurance for health in Germany

- Reimbursements and costs for health insurance

The healthcare system and health insurance in Germany

The German healthcare system has been rated as one of the most advanced in Europe. While all foreigners living or working in Germany have access to subsidized state healthcare, it is compulsory for all residents of Germany to have some type of insurance.

If you’re a German resident, it’s mandatory to register for either a statutory German insurance scheme ( gesetzliche Krankenkasse GVK) oder a private insurance plan ( private Krankenversicherung, PVK).

I’ve talked in detail about the cost which you have to pay when you are going for the health insurance in the other post Healthcare cost in Germany.

Who in Germany needs to have health insurance?

All German residents must have health insurance to cover outpatient and hospital treatment. It is mandatory that all applicants for a German visa show proof of this insurance.

While the vast majority of German workers continue to be covered by the German state-run health insurance system, it is possible to purchase more comprehensive private insurance under certain circumstances.

German health insurance contributions are divided between employees and employers, regardless of whether the scheme is public or private.

German public health insurance

Around 90% of German residents are covered by the state-run healthcare system.

Non-EU and EU nationals who work in Germany are both subject to mandatory state health insurance (also known as gesetzliche Krankenversicherung).

The public health system includes those who are in paid work or vocational training and earn less than EUR60,000. (2019 figures).

Family co-insurance is available to certain individuals, including spouses, civil partners and children (upto age 23 or 25, if you are studying) who are covered by state healthcare.

Contributions are not required if their monthly income is between EUR415 and EUR450, depending on the circumstances.

State healthcare is also available to pensioners and those who have received unemployment benefits or assistance.

Self-employed Germans can get health insurance

In 2019, new rules were introduced to help self-employed workers earning lower wages.

The contributions of self-employed individuals were based on their projected monthly earnings of EUR2,284; this meant that lower-earning people had to pay unreasonable premiums.

The minimum earning limit was lowered to EUR1,038, which could save hundreds of pounds on contributions for those with lower incomes.

Students in Germany need to have health insurance

You will need to pay a premium if you are studying in Germany at an approved state university or educational institution.

If you are over 25 years old and have no children, the monthly cost is currently EUR80. Full-time students can get free coverage under their family’s insurance until age 25.

The premiums will increase by approximately EUR50 per calendar month after you turn 30, or finish your 14th semester.

International students can get health insurance starting at EUR25-30 per calendar month.

Insurance for health of foreign visitors to Germany

If they travel to Germany, or are temporary visitors, citizens from the EU (European Union), EEA or Switzerland can get healthcare on the same terms as German nationals.

Before you can be eligible for state health care, you will need an EHIC (European Health Insurance Card). German residents who plan to stay for more than one year, or those who work in Germany, should either get German health insurance or join an independent insurer.

An expat-friendly broker like Feather will help you find the right insurance plan to meet your medical needs.

Temporary visitors who are not EU members may be eligible to receive state healthcare through reciprocal agreements with their country. They will need to either pay for healthcare or travel insurance if they are not eligible.

What are the benefits of German public health insurance?

German public insurance covers inpatient care at the nearest hospital as well as outpatient care from doctors.

These services are offered across the board. However, if you need private medical care or an individual hospital room, you will need an additional private health plan.

You may not be eligible for certain specialist services, such as eye and dental care. German mental healthcare is accessible on the public system. However, you might have more options privately.

Maternity Care in Germany

The basic costs of childbirth and pregnancy are usually covered by state health insurance.

However, you may be subject to additional charges for certain paperwork required during a birth.

You should verify whether your private insurance covers you if you decide to have your baby in a private hospital. Also, find out what the costs will be for delivery and care.

Germany offers dental insurance

You are more likely to get coverage for routine procedures, such as fillings, hygiene, and emergency situations if you have German state health insurance.

Co-payments have increased due to pressure on the healthcare system. The state may only provide partial coverage for major dental procedures. Private insurance policy holders should check their plans to determine if they have dental coverage.

Otherwise, German dental insurance is either an addition to your existing health insurance or a separate form of insurance.

The cost of dental insurance in Germany is usually low. The monthly cost is around EUR10-20, but you will pay more for better coverage and lower co-payments.

Before you agree to any treatment, ask your dentist for a detailed overview ( Heil– und Kostenplan). This will include information about what is covered by your German dental insurance.

Germany: Sick leave

Your employer will pay your wages up to six weeks. State health insurance also includes sickness benefits. Your insurance company will pay 70% of your regular income for up to 78 weeks. This is over a period of three years.

Statutory sick leave ( Krankengeld ) is available for up to EUR3,176 per calendar month, before taxes. Consider purchasing sick pay insurance if you earn more.

How to apply for public insurance

Your employer will usually register you with a German regional health insurance company. You are allowed to choose any insurer you wish, provided you inform your employer within 2 weeks of beginning work.

Self-employed persons will need to register with a German insurance company.

This is usually an easy process. You need to take your passport and residency permit to the regional office, then fill out the forms.

There are many international and German insurance companies that offer health insurance. The factors that could influence your decision include the insurer’s contribution rate and additional services. They may also make it easier to contact them or provide English-language information.

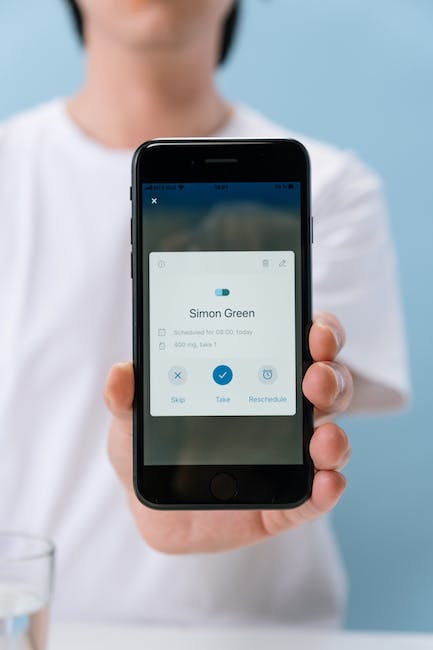

Once you’ve become a member, your health insurer will issue you a card (Krankenversichertenkarte), which you’ll need to show each time you visit a doctor or specialist.

GKV keeps an up-to-date list of all German state insurance companies. Here you can compare rates for health insurance.

Germany Private Health Insurance

Who should have private health insurance?

One-in-10 German residents choose private health insurance. The private medical insurance market is overseen by 40 companies. There are many options available for different budgets.

Your employment status will determine if you are eligible to change from a public to private insurance fund.

You must remain on the statutory system if you earn less that EUR60,750 per annum (or EUR5,063 per month).

If you are unsure, you have the option to choose between state and private insurance.

- Are you self-employed?

- are a civil servant

- Earn more than the salary threshold

- There is no reason to join a state-sponsored insurance program

- You are a student who has renounced your state insurance.

It is not always a good idea to switch to a private fund. Premiums are determined by personal factors. Prices rise with age, health risk, and additional family members.

Private insurance can be an option if you are young and healthy with sufficient income.

You can choose to have a Basistarif if you have severe health problems and are unable to be accepted into a German private scheme. Insurers are required to accept all cases in the same way as the government system.

The average term of membership in an insurance fund is 18 months. Two months notice is usually sufficient to change your health insurance company. This also applies if an increase or supplemental increase has been made (normally, this happens annually).

Benefits of Germany’s private insurance coverage

German private health insurance is more comprehensive and has a shorter waiting time.

Private insurance is not usually free and does not cover children or partners, as opposed to state-sponsored health insurance.

You’ll also have access to specialist treatment and better accommodation.

This means that you will have a shorter wait time and won’t have to pay any extra co-payments. Private insurance makes it easier to find a doctor that speaks your language.

What is private health insurance?

Private health insurance contributions are determined by your risk profile. Contributions to state insurance are based upon your income. This includes your medical history and age.

You will typically have to pay the doctor’s fees upfront, and then request reimbursement later. Contrary to state healthcare, you may be out-of-pocket for some time after treatment.

You will usually receive a complete reimbursement. This is in contrast to state healthcare, where you typically pay a portion of the cost.

You can usually choose the amount of your excess and deduction fees. This allows you to opt to pay a fixed amount per year ( Selbstbehalt). for your treatments.

One way to lower your monthly payments is to choose a higher excess on private health insurance.

You are not required to remain with the company for 18 months, but conditions may be placed by the insurance company.

German private health insurance companies

Private insurance companies are available in Germany. These include both large multinational insurers and local German providers that offer full and supplementary insurance policies. German health insurance providers include:

Compare private German health insurance providers and receive free quotes with our special insurance page.

Reimbursement and costs of health insurance

German social insurance contributions pay for healthcare costs. Around 120 insurers manage state healthcare access.

The state healthcare contribution in 2019 is 14.6% of your net income. You’ll generally pay about half of this amount (around 7,3% for a monthly income of EUR4,538) Automatic deductions are made from your salary.

The remaining fees are covered by your employer, up to a maximum of 7.3%.

Additional contributions are also charged by German state health insurances. These rates can fluctuate from year to year depending on the healthcare spending.

There are many different rates for contribution. They can vary from around 0.3-1 .%),. The employee is responsible for it based on their income. Any changes in their contribution fees must be notified to you by your insurance fund.

Although some insurers have many members, others have only a few thousand. However, it is unlikely that their service will differ significantly. Every insurer must comply with the minimum requirements for healthcare.

However, the additional contribution rate is an important factor to consider when selecting a German insurance company.

German Healthcare Services: Co-payments

In recent years, the German healthcare system has been under increasing pressure to reduce healthcare costs.

The co-payments for some treatments and medications have increased; they will likely increase in the future. State health insurance covers only a portion of the costs in some areas, such as optical, dental and orthodontic care.

State healthcare policies provide coverage for most medical treatments, except those that are more specific. This covers GP visits, hospital care (inpatient or outpatient), medical treatment and x-rays. It also includes rehabilitation and prescription drugs.

You may be required to pay a copayment ( Zusatzzahlungen), in certain cases, for treatment or prescription drugs.

A EUR10 one-time fee will be charged for each quarter you need medical assistance. This charge will not apply if you do not require medical assistance.

Germany Nursing Costs

In addition to the 14.6% premiums paid for state healthcare, you must also join the state nursing care scheme (Pflegeplichtversicherung). This pays for any nursing care (e.g. bathing, feeding, etc.)

2019 contribution rates are 3.05% on your gross salary or 3.3% if there are no children. Maximum monthly payment is EUR150. Your employer may pay up to EUR69

Useful Links

- How do you choose between expat or local insurance

- Ministry of Health Call 030 340 60 666 01 for more information about health insurance.

- GKV Spitzenverband: the head organization for state health insurance.

- PKV Association is the German head organization for private insurance (German).

- Germany social insurances and benefits

Information on health insurance for foreign students: www.hiffs.de and deutscheinsurance.com.

Do you have questions about Germany? then contact us by using our Contact Me page.

Do you have questions about Germany? then contact us by using our Contact Me page. Checkout more posts by us on our Blog.