Why N26 is the Future of Banking in Germany: A Review

In recent years, the banking landscape in Germany has undergone a significant transformation with the rise of digital banking. One of the key players in this space is N26, a German fintech company that has revolutionized the way people manage their finances. Founded in 2013, N26 has quickly grown to become one of the largest digital banks in Europe, with over 7 million customers worldwide.

The success of N26 can be attributed to its innovative approach to banking and its commitment to providing a seamless and convenient user experience. With its user-friendly mobile app and a range of innovative features, N26 has made banking more accessible and convenient for consumers. In today’s fast-paced society, where people are constantly on the go, digital banking has become an essential tool for managing finances.

The Advantages of Digital Banking: Convenience, Flexibility, and Accessibility

Digital banking offers several advantages over traditional banking methods. Unlike traditional banks, which require customers to visit physical branches during limited operating hours, digital banks like N26 provide round-the-clock access to financial services through their mobile apps. This means that customers can manage their finances anytime, anywhere, without the need to visit a physical branch.

Furthermore, digital banking offers greater flexibility compared to traditional banking methods. With N26’s mobile app, customers can easily transfer money, pay bills, and check their account balance with just a few taps on their smartphones. This eliminates the need for paper-based transactions and reduces the time and effort required to complete financial tasks.

Digital banking also offers greater accessibility for consumers. Traditional banks often have strict eligibility criteria and require customers to provide extensive documentation to open an account. In contrast, digital banks like N26 have simplified the account opening process, making it easier for individuals to access financial services. This is particularly beneficial for individuals who may not have access to traditional banking services, such as those living in remote areas or individuals with limited mobility.

N26’s Innovative Features: Mobile App, Real-Time Notifications, and Budgeting Tools

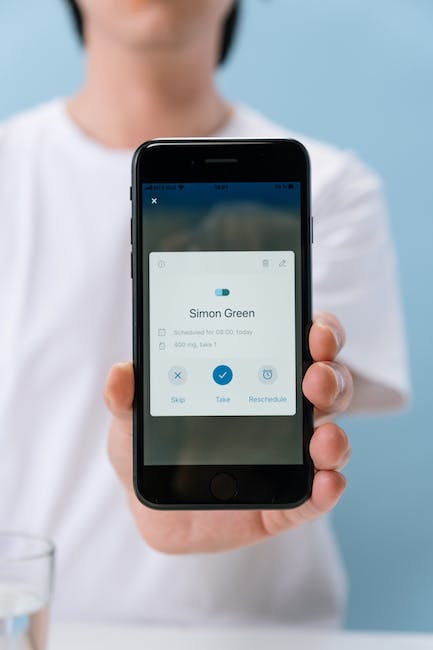

N26’s mobile app is at the heart of its innovative approach to banking. The app provides a user-friendly interface that allows customers to easily navigate through various features and services. From checking account balances to making payments, the app offers a wide range of functionalities that make managing finances a breeze.

One of the standout features of N26’s mobile app is its real-time notifications. Customers receive instant notifications on their smartphones whenever there is activity on their accounts, such as a transaction or a change in balance. This provides customers with a greater sense of control and security over their finances, as they are immediately alerted to any suspicious or unauthorized activity.

In addition to real-time notifications, N26’s mobile app also offers budgeting tools that help customers manage their finances more effectively. The app allows users to set spending limits, track expenses, and categorize transactions. This enables customers to gain a better understanding of their spending habits and make informed financial decisions.

Security and Privacy: How N26 Protects Your Personal and Financial Information

Security is a top priority for N26, and the company has implemented several measures to protect its customers’ personal and financial information. N26 uses state-of-the-art encryption technology to ensure that all data transmitted between the app and its servers is secure. This means that customers can have peace of mind knowing that their sensitive information is protected from unauthorized access.

Furthermore, N26 has implemented multi-factor authentication (MFA) to add an extra layer of security to customer accounts. MFA requires users to provide additional verification, such as a fingerprint or a one-time password, when logging into their accounts or making transactions. This helps prevent unauthorized access even if a customer’s login credentials are compromised.

N26 also has strict privacy policies in place to protect its customers’ personal information. The company adheres to the General Data Protection Regulation (GDPR), which sets out strict guidelines for the collection, storage, and use of personal data. N26 only collects the necessary information required to provide its services and does not share customer data with third parties without explicit consent.

The Benefits of a Cashless Society: N26’s Support for Contactless Payments

The shift towards a cashless society has been accelerated in recent years, and N26 is at the forefront of this trend with its support for contactless payments. Contactless payments offer several advantages over traditional payment methods, such as cash or card swiping.

Firstly, contactless payments are faster and more convenient. With just a tap of their smartphone or card, customers can make payments quickly and easily, without the need to fumble for cash or enter a PIN. This saves time for both customers and merchants, making the payment process more efficient.

Secondly, contactless payments are more secure. Unlike cash, which can be lost or stolen, contactless payments require authentication through biometric data or PIN entry. This adds an extra layer of security and reduces the risk of fraud or theft.

N26 has embraced the shift towards a cashless society by offering contactless payment options to its customers. The N26 mobile app supports contactless payments through various methods, including Apple Pay and Google Pay. This allows customers to make secure and convenient payments using their smartphones or wearable devices.

N26’s Competitive Fees and Transparent Pricing Model

One of the key advantages of N26 compared to traditional banks is its competitive fees and transparent pricing model. Traditional banks often charge high fees for services such as account maintenance, ATM withdrawals, and international transactions. In contrast, N26 offers a range of free services and competitive fees for premium features.

For example, N26 offers a free basic account that includes features such as free ATM withdrawals, free payments in any currency, and real-time notifications. Customers can also upgrade to premium accounts, such as N26 You or N26 Metal, which offer additional benefits such as travel insurance and exclusive partner offers. The fees for these premium accounts are transparent and clearly communicated to customers, allowing them to make informed decisions about the services they require.

N26’s transparent pricing model is a refreshing change from the complex fee structures often associated with traditional banks. Customers can easily understand the costs associated with their accounts and avoid unexpected charges. This transparency helps build trust and loyalty among customers, as they feel confident that they are getting value for their money.

Customer Service: N26’s Commitment to Providing Excellent Support

Customer service is a crucial aspect of any banking experience, and N26 is committed to providing excellent support to its customers. N26 offers multiple channels for customer support, including live chat, email, and phone support. The company also has an extensive knowledge base and FAQ section on its website, where customers can find answers to common questions.

N26’s customer service team is known for its responsiveness and efficiency. Customers can expect prompt and helpful assistance when they reach out for support. The company also takes customer feedback seriously and continuously works to improve its services based on customer input.

In addition to traditional customer support channels, N26 has also embraced social media as a means of engaging with its customers. The company has an active presence on platforms such as Twitter and Facebook, where customers can reach out for support or share their experiences. This social media engagement helps foster a sense of community among N26 customers and allows the company to address customer concerns in a timely manner.

N26’s Global Expansion and Partnership with Other Financial Institutions

N26’s success in Germany has paved the way for its global expansion. The company has expanded its services to other European countries, including France, Spain, Italy, and the United Kingdom. This expansion has allowed N26 to reach a wider customer base and establish itself as a leading digital bank in Europe.

In addition to its global expansion, N26 has also formed partnerships with other financial institutions to enhance its services. For example, N26 has partnered with TransferWise to offer international money transfers at competitive rates. This partnership allows N26 customers to send money abroad quickly and securely, without the need for a separate account or service.

N26’s partnerships with other financial institutions are mutually beneficial, as they allow the company to offer a wider range of services to its customers while also expanding its reach. These partnerships demonstrate N26’s commitment to providing a comprehensive and integrated banking experience for its customers.

N26’s Integration with Third-Party Services: Seamless Access to Financial Products

N26 has embraced the concept of open banking by integrating with third-party services. This integration allows N26 customers to seamlessly access a wide range of financial products and services through the N26 app.

For example, N26 has integrated with platforms such as MoneyBeam and Raisin, which allow customers to send money to friends or family members and earn interest on their savings, respectively. These integrations provide customers with added convenience and flexibility, as they can access these services without having to leave the N26 app.

The integration with third-party services also allows N26 to offer personalized recommendations and tailored financial products to its customers. By analyzing customer data and preferences, N26 can suggest relevant products and services that meet the individual needs of each customer. This personalized approach helps customers make informed financial decisions and ensures that they are getting the most out of their banking experience.

N26’s Sustainability Efforts: A Commitment to Environmental and Social Responsibility

In addition to its innovative features and excellent customer service, N26 is also committed to environmental and social responsibility. The company has implemented several sustainability initiatives to reduce its environmental impact and contribute to a more sustainable future.

N26 has made a commitment to carbon neutrality by offsetting its carbon emissions through various projects. The company also encourages its customers to adopt sustainable practices by offering rewards for eco-friendly actions, such as using public transportation or reducing plastic waste.

Furthermore, N26 is actively involved in social initiatives and supports various charitable organizations. The company has partnered with organizations such as the United Nations World Food Programme and SOS Children’s Villages to make a positive impact on society. These initiatives demonstrate N26’s commitment to corporate social responsibility and its dedication to making a difference in the world.

Why N26 is the Future of Banking in Germany and Beyond

N26 has emerged as a leader in Germany’s banking landscape, thanks to its innovative approach to banking and commitment to providing an excellent user experience. With its user-friendly mobile app, real-time notifications, and budgeting tools, N26 has made banking more convenient and accessible for consumers.

The company’s focus on security and privacy ensures that customers’ personal and financial information is protected at all times. N26’s support for contactless payments aligns with the shift towards a cashless society, offering customers greater convenience and security.

N26’s competitive fees and transparent pricing model make it an attractive option for consumers looking for an alternative to traditional banks. The company’s commitment to providing excellent customer service further enhances its appeal.

As N26 continues to expand globally and form partnerships with other financial institutions, it is well-positioned to become the future of banking not only in Germany but also beyond. With its integration with third-party services and sustainability efforts, N26 is setting new standards for the banking industry and demonstrating the potential of digital banking in the future.

Do you have questions about Germany? then contact us by using our Contact Me page. Checkout more posts by us on our Blog.